#3: How To Trade Small Account

Lesson 3

Hey hey, what's up my friends!

In today's lesson, you'll discover how to trade with a small forex trading account.

We are going to do this without blowing up your trading account or without taking huge risks

If you follow the tips I'm about to share with you…

You can even take a small trading account of yours and grow it to 6 figures and beyond.

Sounds good?

Then let’s begin…

Find the right broker

The first tip I want to share with you is you must find the right broker when you are trading with a small Forex account.

You must find a broker that lets you trade micro lots or even nano lots.

You may ask, what is micro or nano lots?

Here’s what they mean:

Standard lot (1.0) = 100,000 units

Mini lot (0.10) = 10,000 units

Micro lot (0.01) = 1,000 units

Nano lot (0.001) = 100 units

You want to find a broker that allows you to trade 1000 units and below.

This way, it allows you to better manage your risks.

If you want to find a broker that lets you trade 1000 units or less, you must find a broker that adopts a market maker business model.

Only if the broker adopts a market maker business model can you such size.

I know what you’re thinking…

“But Rayner, market maker hunts my stop loss blah blah blah.”

No, it’s not true.

I've done a lesson that explains why a market maker broker is simply a business model and doesn't have the incentive to hunt your stop loss.

If they do…

They’ll be out of business pretty soon.

Now, let me explain why you must find such broker…

Broker with a minimum of mini lot per trade

Let’s say you have a $500 trading account and you have a maximum risk of $5 if your trade hits your stop loss (1% risk per trade).

If you have a broker that lets you trade a minimum of 10,000 units (Mini lot), 1 pip move against you will cost you $1

Now…

What can you conclude?

You can conclude that the maximum size of your stop loss on a trade can only be 5 pips!

Can you see?

5 measly pips.

Chances are you're going to get stopped out of the trade immediately because your stop loss is way too tight.

This is the problem trading with brokers that offer a minimum of 1 mini lot.

Your stop loss is too tight and your trade doesn't have room to breathe.

On the other hand…

Let's say you have a broker that offers you micro lot.

What's the difference?

Broker with a minimum of micro lot per trade

This time, 1 pip against you is now $0.10

Which means, if you are risking 1% of your $500 account ($5), then you can have a maximum stop loss of 50 pips per trade!

You now have 50 pips of buffer to place your stop loss.

Your stop loss can now be wider.

This is the difference between trading with a broker that offers 0.1 lot (Mini lot), and a broker that offers 0.01 lot (Micro lot).

This is important because you want to adopt proper risk management.

It doesn't matter whether you're trading on $500 or a $50,000 trading account.

Your risk management is paramount.

If you don't apply proper risk management on a small account…

Those habits will be brought forth when you're trading a larger account.

And that’s when things go really wrong on a larger scale.

Moving on…

Add Fund Regularly To Your Trading Account

The next tip I have for you is that you want to add funds regularly to your trading account, especially when you know your trading results are already consistent.

Don’t have the mindset thinking, “Oh I’m going to take a few hundred dollars and turn it into millions in a matter of a few years.”

Trust me, it's not going to happen.

For every success story you hear, there's another 99.99% of failure stories you don't hear.

That is why news media wants to sensationalize how you can easily get rich in trading.

These headlines suck in new trades to come in and try and then lose money along the way.

Bear this in mind, okay?

Don't wish or hope to take a small account and ramp it up to 6 or 7 figures instantly.

Let me explain.

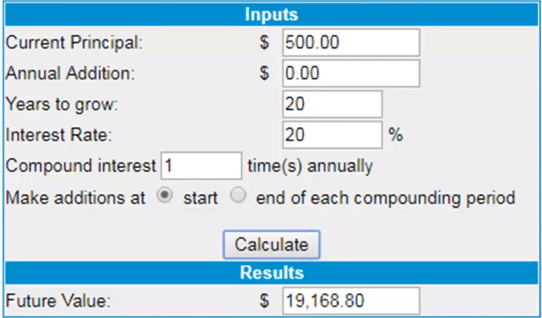

For example, you have a $500 trading account again and you grew it for 20 years with a return of 20% a year.

You would have about $19,000:

If you ask me, that’s not really a lot.

If you work full-time, you can probably make more than $19,000 after 20 years.

Now…

What if you start to add funds regularly to your trading account?

Maybe you have a full-time job and you put in extra money every month into your trading account.

In this case…

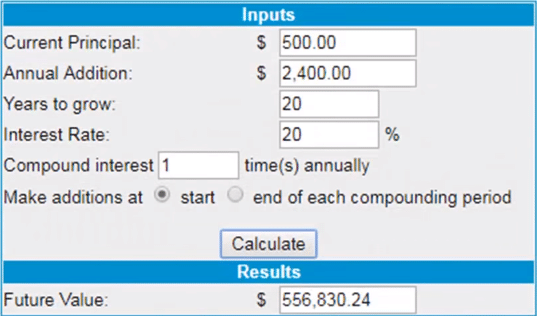

You have a starting capital of $500 and you add $200 every month ($2,400 a year) with a return

of 20% a year.

How much would that be after 20 years?

Let’s see…

More than half a million dollars just by saving the additional $200 a month and funding it to your trading account.

Can you see the huge difference between not adding funds to your account and adding funds to your account?

The difference is a lot.

So if you have a small account, it's not the end of the world!

If you have proper risk management, you add your funds regularly, and you trade with an edge…

You can still grow that small account into something substantial.

Now, you want to do this only when your results are getting some consistency.

If you're still losing consistently and you add more funds then you are only adding fuel to the fire.

Next…

Think in Terms of R

Let’s say that you’re trading $500 and at the end of the year…

You only made $100 out of the $500 account, and you think that it looks pathetic!

You’re probably thinking, “Rayner I spent so much time and effort learning how to trade and I make a measly hundred dollars!”

I know how you feel.

This is why I say that you must think in terms of R and not the dollar amount that you make.

So, what is R?

R is basically the return you make relative to the risk that you've taken.

Let's say for you risk $10 on a trade and you make $100.

Take your total gain and divide it by your initial risk.

$100/$10 = 10R

= 10R

You have a gain of 10R, otherwise known as a 1:10 risk to reward ratio.

This is how you calculate your R multiple.

Similarly, let’s say you risk $10,000 on a trade and you only made $1,000 on that trade.

What is your R multiple?

Again, take the gain and divide it by your initial risk.

$10,000/$1,000 = 0.1R

= 0.1R

Now you realize that you only gained 0.1R

So, who is a better trader?

The trader who achieved 10R or the trader who achieved 0.1R

Well, if you ask me…

The trader who achieved a 10R gain on the trade definitely has a better performance than a trader who just made 0.1 even though he made more money.

This is what I mean by thinking in terms of R.

Even though your account is small…

Don't think how many dollars or how many cents you're making, think in terms of R or think in terms of average returns per month or per year.

Lastly…

Profit From Your Mistakes

The final tip that I want to share with you is that when you're trading a small account as a beginner, you want to learn and profit from your mistakes.

Because when you're trading a small account, that's when the mistakes are not so costly.

Blowing up a $500 account with mistakes is better than blowing up a $500,000 account.

As you start with a small capital, expect to make all the mistakes a trader goes through.

You couldn't be as bad as you are when you get started in trading as long as you profit from mistakes.

Eventually, those will be the same mistakes that you can avoid by the time you will be trading a large account.

So let me ask you 3 questions:

1. What is your mistake?

The mistake could be clicking buy instead of clicking sell.

You basically, messed up your order as you didn’t know that you clicked on buy instead of sell.

Another mistake is that instead of risking 1% on the trade, you risked 10%

2. Why do you make it?

Maybe it's because you're new to the platform, your cat went into your computer, you were in a rush, etc.

Also, you may have risked 10% because you’re manually calculating the size of your position and there’s an error in your calculation.

3. How will you prevent it?

Quite simply, if you want to prevent yourself from making such silly mistakes, open up a demo account, lock yourself in a room where your cat won’t get in, and take your time making trading decisions.

One way to also avoid making errors in position sizing is to use a position sizing calculator.

That's how you can actually learn and profit from your mistakes!

With that said, let's do a quick summary…

Summary

- Find a broker that allows you to trade micro lots

- Add funds regularly

- Think in terms of R, not $

- Profit from your mistakes