#7: Which Are The Best Forex Pairs To Trade?

Lesson 7

In today's lesson…

I am going to talk about how to choose the best Forex pairs to trade.

If you hang around forums, read books, listen to trading gurus, they’ll tell you these:

- You should focus on the spread

- You should focus on the most liquid markets, the most liquid currency pairs

But I'm here to tell you – those shouldn't be of your concern.

Why is that?

Spread

First, let's talk about the spread.

If you trade major currency pairs or the crosses, the spread is generally reasonable.

Because the Forex broker industry is so competitive, the spread has been steadily declining over the years.

The spread isn’t going to be atrocious, it's going to be reasonable.

If you’re going with a reputable broker, the spread that they offer will be tight and decent to start with.

So the spread shouldn't be your main concern.

Liquidity

The Forex market is the most liquid markets in the world.

If you're not a day trader trading a 7 or 8-figure account, you don't have to worry about liquidity.

If you’re trading less than 10 lots, you don't have to worry about liquidity.

Because the market is very liquid!

Whatever order that you put into the markets is probably not going to make a difference at all.

Imagine this:

You take a pail to scoop up water from the sea and pour the water onto the land.

Is it going to make much of a difference to the sea?

No, not really.

Because it's only a small pail!

And it's the same for liquidity.

If you're going to trade like 1 lot, 1 mini lot, 2 lots…

It’s not going to make an impact on the liquidity of the Forex markets.

So now you might be thinking:

“Okay Rayner, I don't have to be concerned about the spread nor liquidity.”

“So what should I be concerned with?”

“How do I choose the best Forex pairs to trade?”

Don’t worry.

That's what I'll get to right now.

Understanding the market behaviour

To decide the best Forex pairs to trade, you need to pay attention to the market behaviour.

That's right.

You’ll want to know whether the market that you're trading is:

- A trending market

- A mean reverting market

Why is that?

If you’re employing a trending or a breakout trading strategy, then you’ll want to be trading a market that tends to trend.

If you apply those strategies to a mean reverting market, you’ll suffer losses consistently over time.

Because if the market tends to mean revert, then breakout tends to fail.

Likewise, if you’re applying a mean reverting or a counter-trend strategy, you don’t want to do it on a trending market.

Because the market tends to trend.

So now the question is…

How do I know whether the market is trending or mean reverting over time?

I want to share with you this technique that I've learned from Andrea Unger.

A simple test

This will tell you whether the market you’re trading tends to behave in a trending or in a mean reverting manner.

You can do this via backtests.

(I’ve used a backtesting platform, MultiCharts if you’re wondering.)

So what you want to do is to:

- Buy the breakout of the previous day high.

- Hold the long position till the price hits the previous day low, and go short

- Hold the short position till the price breaks above the previous day high, and go long

- Rinse and repeat over again

In essence, you're simply buying breakouts and shorting breakdowns.

The purpose of doing this is to find out the result of this simple test.

Think about this:

If a market has a trending behaviour, then the equity curve should slope up over time.

Because each time you buy a breakout, you’ll hold the trade until it hits the previous day low to exit the trade.

On the other hand, if you do this and realize a particular market or currency pair having an equity curve that’s sloping down…

It means that whenever you buy the highs or short the breakdown of the previous day low, you tend to lose money.

This tells you that this market has a mean reverting characteristic.

Let me share with you the findings that I’ve got.

Trending markets

Here are a couple of markets that trend well:

- USD/JPY

- USD/CNH

I’ll share the data with you.

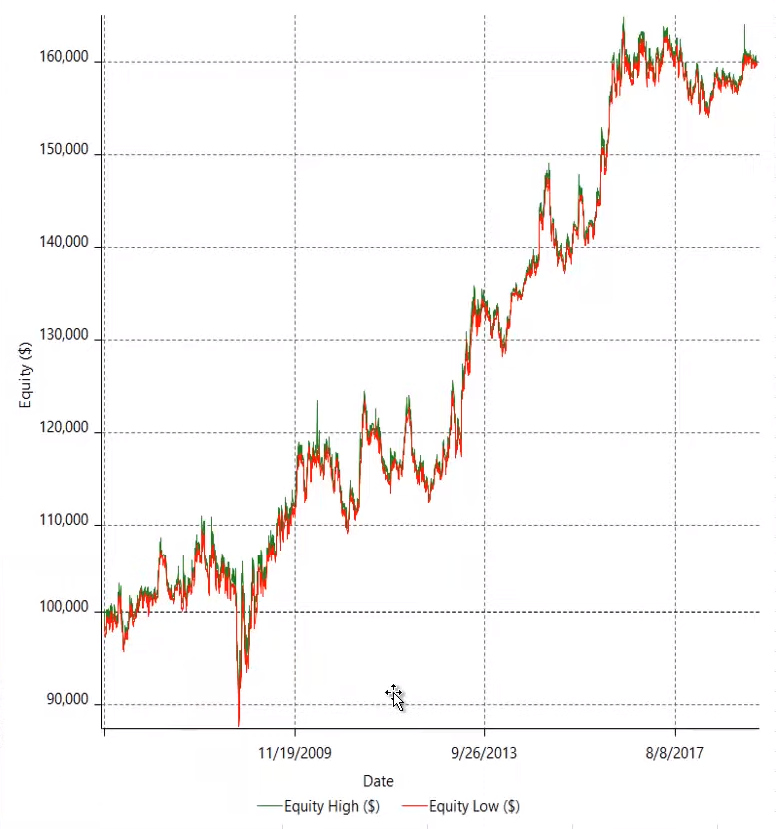

Example #1

This is for USD/JPY.

The key thing that I want to point out is the equity curve over here:

From 2008 onwards, the USD/JPY pair’s equity curve has been sloping up higher.

It's telling you that USD/JPY is a trending market.

Whenever you buy the breakout of the highs, the market tends to go up for a few days.

It’ll then reverse down lower and hit the lows to continue down lower.

So the USD/JPY is a trending market.

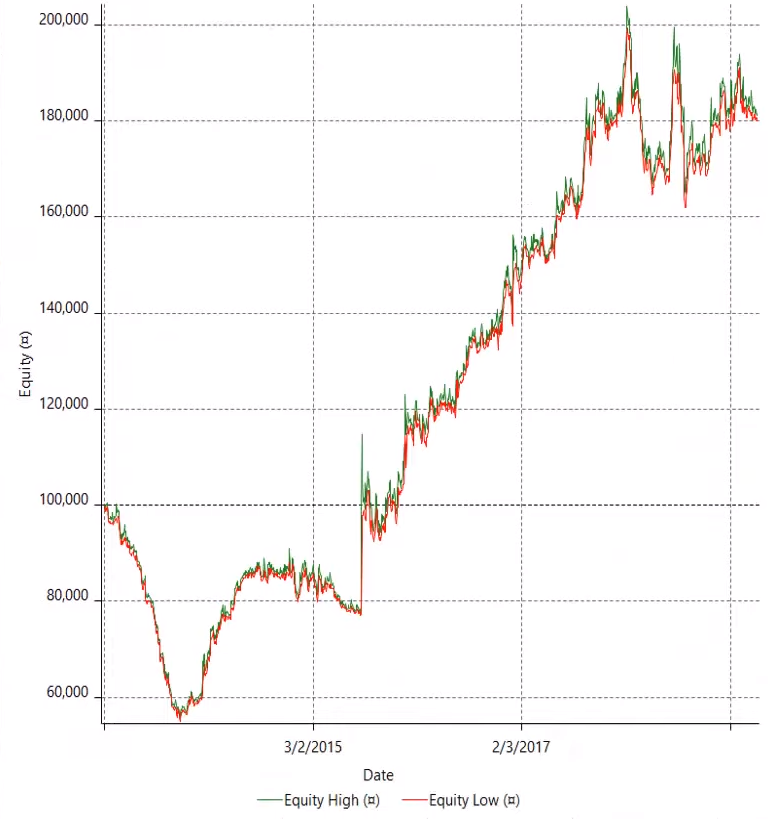

Example #2

Next, is for USD/CNH.

You can see that this is another currency pair with a trending market.

This means that you want to be trading breakouts or trend continuation trades on the USD/CNH.

So these are a couple of trending markets in the Forex markets.

What about mean reverting markets?

So let's check it out…

Mean reverting markets

They are:

- AUD/CAD

- AUD/NZD

(I’ve applied the same system, buying the break of the highs and shorting the breakdown of the lows.)

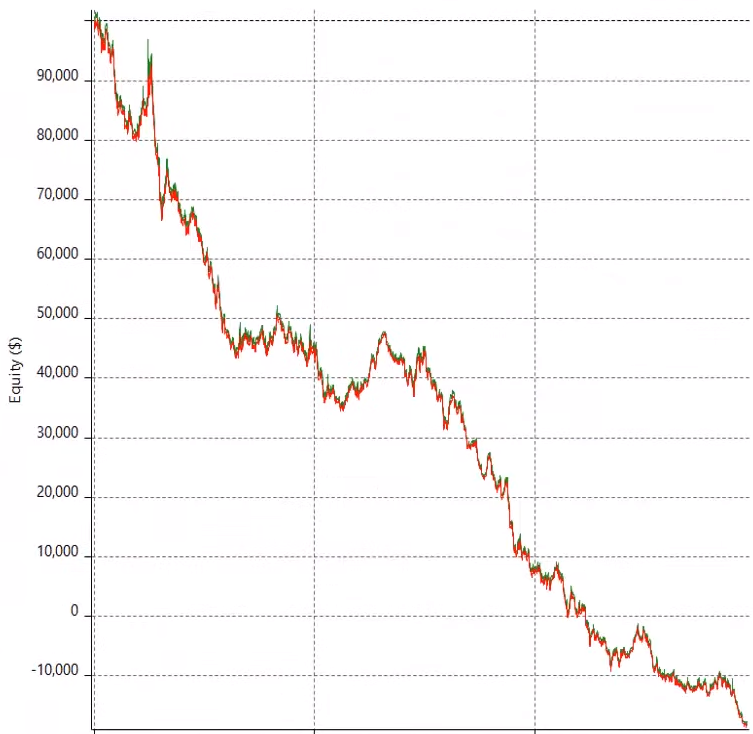

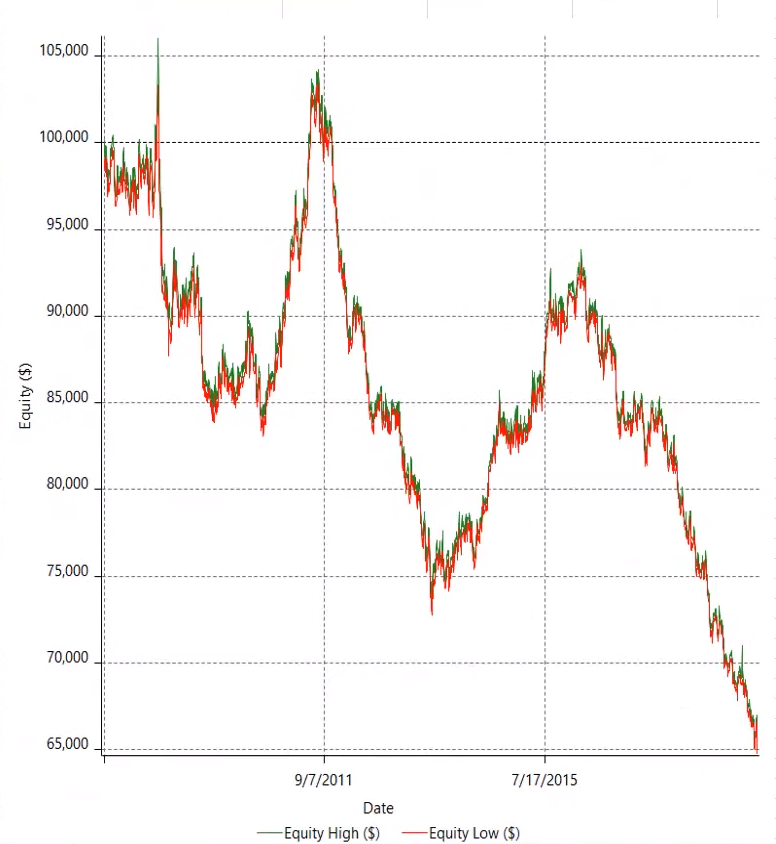

Example #1

This is the AUD/CAD.

For this market, the equity curve is going down steadily over time.

This means that for AUD/CAD, this simple strategy tends to lose money over time.

So this tells you that AUD/CAD is not a trending pair.

Example #2

Another one is AUD/NZD.

A similar phenomenon, you can see that the equity curve is also heading down steadily over time.

It tells you that AUD/NZD is another mean reverting currency pair!

So now…

What do you do with this information?

“Okay Rayner, I know USD/JPY and USD/CNH is a trending market.”

“I know the AUD/CAD and the AUD/NZD is a mean reverting currency pair.”

“So what?”

Here's what:

This tells you that if you’re applying a trending or a breakout strategy, you want to focus on currency pairs that have trending characteristics.

It would greatly increase the odds of your trade working out.

Does it make sense?

Likewise, if you’re a counter-trend or a mean reverting trader, you’ll want to trade currency pairs that have mean reversion characteristics.

How to trade in a trending market

For trending markets, I’ve mentioned that you can trade trend continuation or breakout trades.

So let me share with you an example.

Let's talk about USD/CNH.

I’ll apply simple technical analysis with the statistical data that you’ve learned for this currency pair.

USD/CNH is a trending market.

It had a declining stage lower:

Then the market went into this range over here:

What's interesting is that this market is showing signs of bottoming out.

Entering the trade

Then you have this build-up formed over here:

If you see this pattern, from a technical analysis standpoint, this is actually bullish.

It’s a sign of strength.

Because buyers are willing to buy at these higher prices at resistance.

What we can do is to simply buy the breakout of the highs.

On top of it, I’ve shared the statistical data – USD/CNH is a trending market.

So this should give you the confidence to buy breakouts on this market since it has a valid

technical trading setup.

Exiting the trade

The next thing is how you can trail your stop loss.

Couple of ways you can trail your stop loss:

1. Use a 20-period moving average

You can trail your stop loss until price breaks and close below this 20MA over here:

Alternatively…

2. Trail your stop-loss on the weekly timeframe

You would have entered here:

You can exit your trade when the price breaks and closes below the previous week’s low.

So those are a couple of ways you can trail your stop-loss.

It's nothing rocket science over here.

You’re just taking statistical data which shows that USD/CNH tends to trend over time.

And you overlay it with a simple technical analysis like buying breakouts after build-up forms at resistance.

Or maybe buying a pullback towards the 20MA.

It’s all just very simple technical analysis tools.

But when technical analysis is combined with statistical data – it’s powerful stuff.

The key thing I'm trying to share with you is this:

When you're trading markets that tend to trend, you want to be trading setups that are in the direction of the breakouts.

So that's a couple of examples over here, for trending markets.

With that said...

I wish you good luck and good trading, and I'll talk to you soon